With household spending and the cost of living at the centre of the federal budget, 9news.com.au and Joel Gibson are helping bust the budgets of Aussie families.

Kelly and her family are hard workers, diligent savers and survive on a strict budget.

The Perth mother and grandmother, however, often struggles like many Australians when it comes to unexpected bills.

Kelly told 9news.com.au her family's medical bills often ate into their weekly budget and savings despite doing everything they could to reduce costs elsewhere.

READ MORE: This Sydney family spends a staggering $2.5k every single week

Groceries are the second-biggest weekly cost after their mortgage, which can be higher than average due to Kelly's son's specific dietary needs.

"Our youngest is coeliac, so most our foods are gluten-free as he is super sensitive but due to costs being so high we have a separate pot and pan to cook gluten foods," Kelly said.

"We also sometimes go to a free food outlet and get few items of whatever is available that week. We are thrifty and make and bulk foods up with veggies."

READ MORE: Brisbane single mum's $200 bill shock in cost-of-living crisis

Kelly also rarely eats out, revealing that the family spends a maximum of $40 on takeaway every month.

It also helps having their adult daughters, aged 19 and 21, help to pay a portion of the household bills, including electricity.

"We have an account everyone puts money into, so when a bill comes in we pay from that," Kelly added.

9news.com had personal finance expert Joel Gibson take a look at Kelly's average weekly bills and he has some helpful tips for making their budget stretch even further.

READ MORE: The $1150 weekly cost that hurts this Aussie couple's bank account

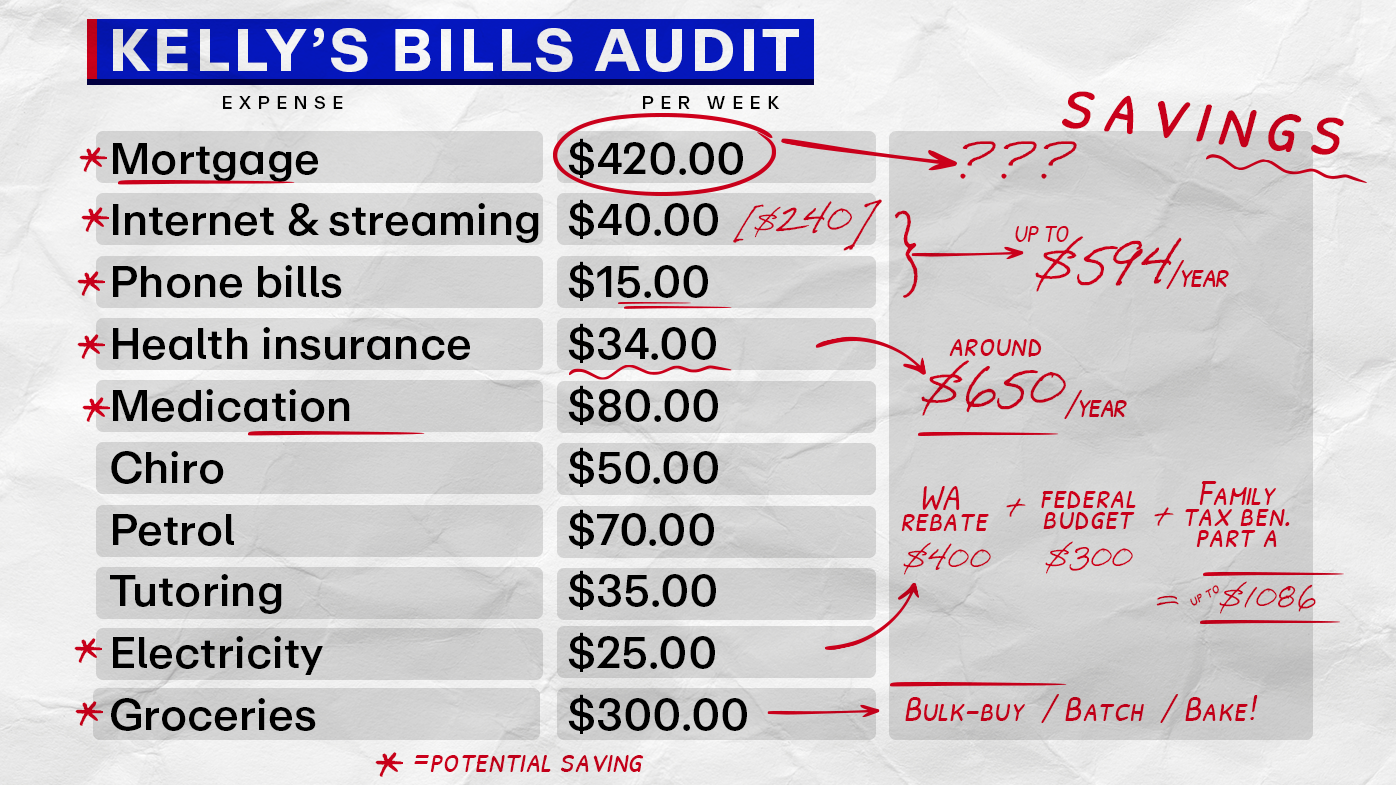

- Mortgage: $420

- Internet and streaming services: $160 per month, $40 per week

- Phone bills: $60 per month, $15 per week

- Health insurance: $137.18 per month, $34 per week

- Cleaning and essential oils: $140 per month, $35 per week

- Tutoring: $35

- Chiro: $50

- Meds: $80

- Petrol: $70

- Groceries: $300

- Takeaway: $10 per week, $40 per month

- Electricity: $300 per quarter, $25 per week

All up, Kelly's weekly bills amount to $1114 per week.

Health and medical: Save around $650 per year

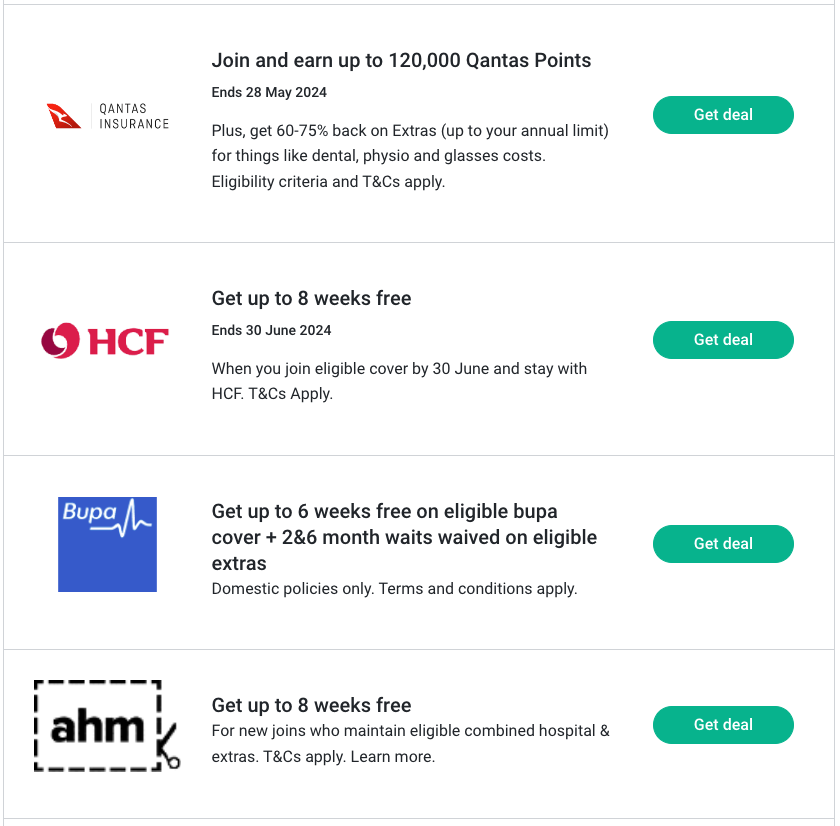

"It's much easier than it used to be to compare health insurance policies because they're all now categorised as gold, silver, bronze or basic," Gibson said.

"So you can look at bronze policies with other insurers and see how they compare.

"For example, an HBF Bronze Hospital Plus family policy starts from $2001 per year, while Bronze Plus cover starts from $1728 at AHM and $1726 at HCF.

"Importantly, if you switch to the same level of hospital cover you don't have to serve any new waiting periods - they carry across with you.

"You can use the government site privatehealth.gov.au to compare similar policies or use a free comparison service such as Compare Club or Compare the Market.

"By switching, you can also score hundreds of dollars worth of incentives for new customers.

"For example, both AHM and HCF are currently offering up to eight weeks free for new customers to switch across.

"At One Big Switch (where I work), you can get the HCF offer with an extra $300 bonus for families."

Here are some examples of current deals listed at the Finder website:

In response to this recommendation, Kelly told 9news.com.au her current health cover, which offers her a high dental debate, is something that HBF no longer offers as she's been with them for 25 years.

Telco: Save up to $594 per year

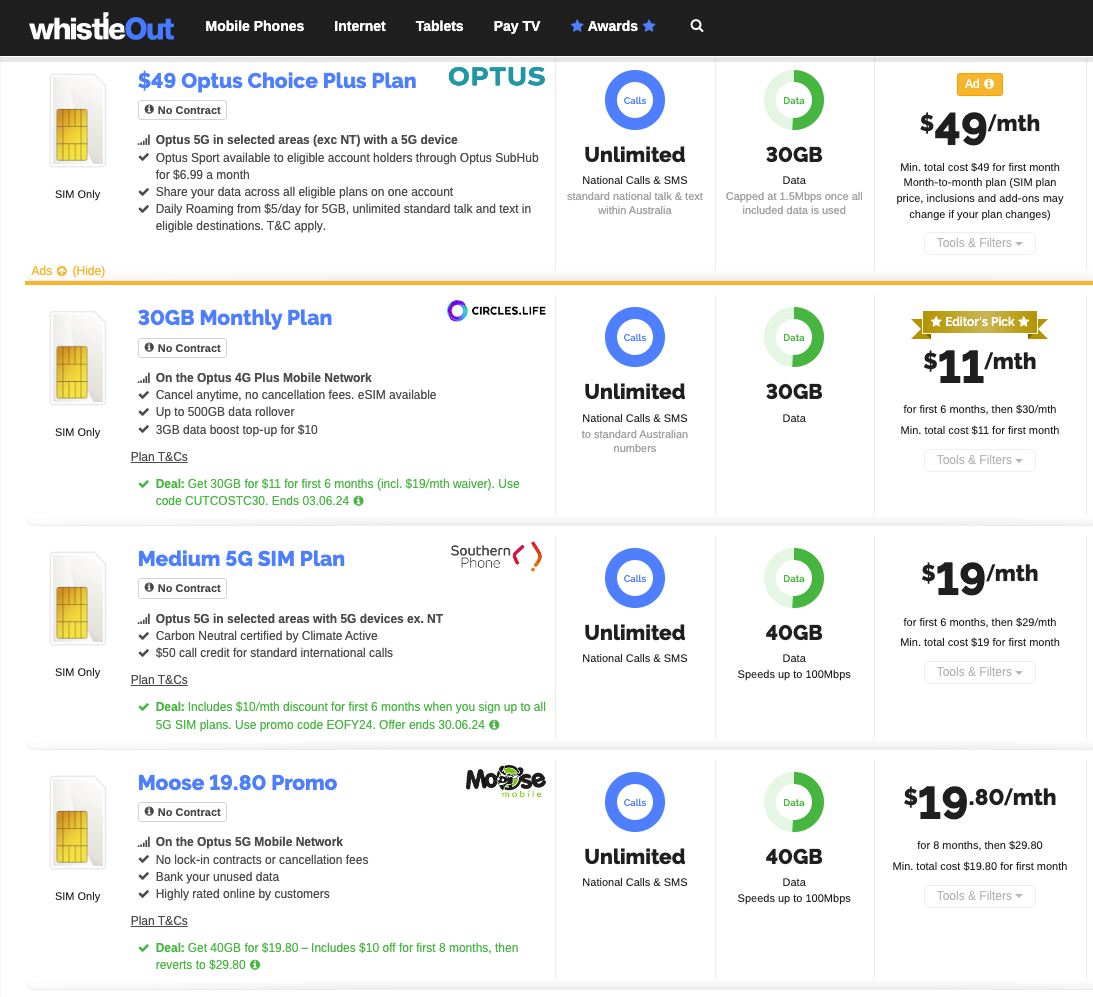

Kelly gets 80GB for her $50 per month plan, a data plan that her provider doesn't offer anymore.

She owns her Apple iPhone outright.

If she was willing to have less data, she could switch to a smaller gigabyte plan – but for a little less per month.

"There's not much cheaper than the $10 per month Woolworths Mobile plan that Kelly's son is on," Gibson said.

"But if she's paying Optus $50 per month then there could be a saving available - owning her phone means she can easily switch to cheaper plans.

"The big brands tend to cost a bit more but the smaller, cheaper brands use the same network and some are even owned by the big guys.

"Optus currently offers 30GB for about $50, while there are others that offer the same amount of data on the same network starting from $11-$19 for six to eight months, then $30 per month, as this comparison shows:

"Their NBN is about $95 per month, which is a typical price for a FastNBN plan with download speeds of around 100Mbps.

"Another quick search of Whistleout shows, however, that the cheapest FastNBN plans start around $65 per month for six months, then rise to $85 per month, so that could mean a saving of about $240 by switching."

Energy: Up to $1086 in rebates

"Unfortunately, West Australians can't switch to save on energy bills because there's only one government-owned provider," Gibson said.

"Fortunately, the WA government announced another $400 rebate for all households this month and the federal budget confirmed another round of $300 rebates for all households.

"If Kelly isn't receiving the Family Tax Benefit Part A, it might be worth looking into because that could also entitle her family to a Health Care Card and bring their state-based rebates up to as much as $1086."

Groceries

"I live with two coeliacs so I know how annoying it is to have to pay more for everything!" Gibson said.

"Making your own food, such as bread and cakes, where possible, saves a lot of money and bulk-buy warehouses such as Costco have some GF products that you can store.

"Otherwise, it looks like they're doing all the smart things to save on groceries: bulk-buying, freezing, batch-cooking and using lots of veggies.

"Frozen veggies can be 50 per cent cheaper than fresh ones, as can 'ugly' fruit and veg and market produce – so incorporate any of those strategies too if possible."

Mortgage: You never know...

"Give your lender a call," Gibson said.

"Ask them if they can go any lower on your rate.

"Mention you've seen rates as low as 5.90 per cent at comparison sites like Ratecity and Canstar.

"You just never know… they might play ball."

Joel Gibson is the author of EASY MONEY, and a money-saving expert on TikTok, TODAY, 2GB, and ABC Radio.The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

from 9News https://ift.tt/lHS9OD1

via IFTTT

Comments

Post a Comment