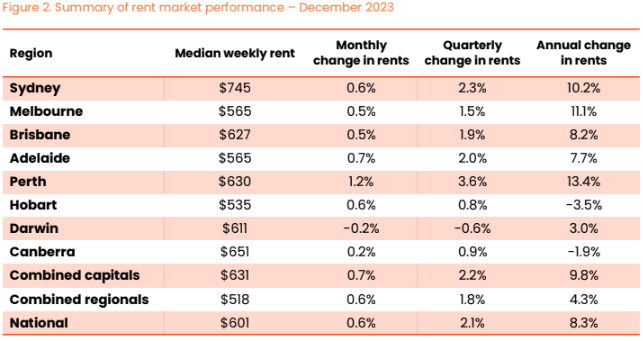

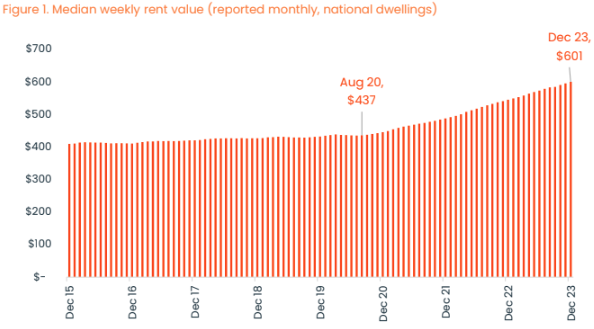

Australia's rental prices have reached a new record high, breaking through the $600-a-week barrier for the first time.

The 8.3 per cent jump in the national median was reflected in all but 16 markets around the country, as experts pointed to an immigration spike, temporary interest-rates-based investment "shock" and even a move away from share housing to explain the latest signs of the housing crisis.

The news is particularly critical in Sydney, where CoreLogic figures put the median weekly outlay at $745, rising beyond $1000 in the Eastern Suburbs and to almost $1170 on the Northern Beaches.

READ MORE: Low-income earners to benefit under Albanese government's stage three tax cut overhaul

CoreLogic said the average household now needed to spend 31 per cent of its income to pay the median rent, up from 26.7 per cent in March 2020.

In dollar terms, the national median leapt $164 a week — more than $8000 a year — in roughly the same period.

"The reduction in social housing supply as a portion of all dwellings over the decades has placed more pressure on the private rental market, as has a declining rate of home ownership," CoreLogic head of research Australia Eliza Owen said, in the company's latest rental market update, released overnight.

"Average household size has also been gradually declining over decades due to economic and demographic factors (for example, more people living alone), requiring more dwellings to house a given population.

"Rent value increases have broadly outpaced wage and income rises at the national level, meaning rental affordability has also deteriorated."

READ MORE: Man on run after hitting pedestrian and crashing into house, sparking a fire

Despite the doom and gloom, there were some positive notes for renters.

Darwin and Hobart were the only state capitals to see some relief but the rate of the increase slowed nationally, down from a peak of 9.6 per cent in the year to September 2022.

The trend was most obvious in the regions, where rents rose 13.4 per cent in the year to August 2021 but dropped to 4.3 per cent annually in December.

A slowdown in increases was only really obvious in the capital cities from April last year, Owen said.

"The easing in rent growth is good news with regard to inflation, but there was a slight pick-up in annual growth once again in the final quarter of 2023," she said.

READ MORE: Rye Carnival operators face 133 criminal charges over alleged child employment

"This 're-acceleration' in rents was most consistent across the capital city house markets, but was also evident in regional rent markets."

In seeking to explain the increase, CoreLogic pointed to three relatively recent trends on top of longer-term reductions in social housing supply and shrinking households.

The newer phenomena included a population surge after COVID-19 restrictions were lifted, and a "temporary shock to investment housing activity" as interest rates rose.

A move away from share housing also drove an even more "notable" reduction in house sizes since late 2020, the research organisation said.

CoreLogic bases its figures on advertised rents, rather than those actually being paid, which it says makes it a "leading indicator" of future Consumer Price Index figures.

from 9News https://ift.tt/L27YVe4

via IFTTT

Comments

Post a Comment