There could be good news on the horizon for Australia's mortgage holders, according to new predictions from a major international organisation.

The Organisation for Economic Co-operation and Development latest economic outlook released overnight laid out an assumed timeline for interest rate relief, while predicting growth would slow further and unemployment would start to rise.

Existing higher rates and cost of living pressures would dampen household and business spending, the group of wealthy countries suggested, but foreign students and tourists would "partly offset" the dip, along with population growth.

READ MORE: Fragile truce in Gaza holds despite reports Israeli troops being injured in clashes with Hamas

The OECD's projections assumed the cash rate would remain where the RBA lifted it to in November – 4.35 per cent – until at least the third quarter of next year.

From there, the Paris-based organisation predicted 75 basis points of cuts to the end of 2025, bringing the rate down to 3.6 per cent.

The latest OECD Economic Outlook also had good news in terms of inflation, which it expected to moderate thanks to easing global pressures.

"The global economy has shown real resilience," Cormann said.

"In the first half of this year, the rate of global growth was back close to the pre-pandemic average. Inflation, even if still too high, has come down from last year's peaks.

READ MORE: Woman wakes to 'something sharp on her face' after mum allegedly murdered

"Still, recent indicators do suggest a mild slowdown ahead. As expected, and indeed as intended economies are feeling the impact of the necessary monetary policy tightening over the past two years."

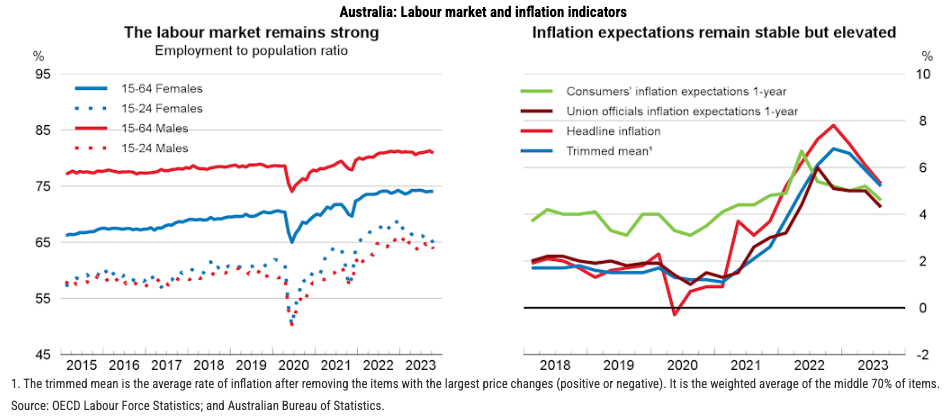

RBA governor Michelle Bullock last week described the persistent inflation issue in Australia as "increasingly homegrown" and warned the bank could lean on rates further if necessary.

The news from the OECD was not as positive on the jobs front, with unemployment predicted to rise to 4.4 per cent in 2025, or medium-term growth.

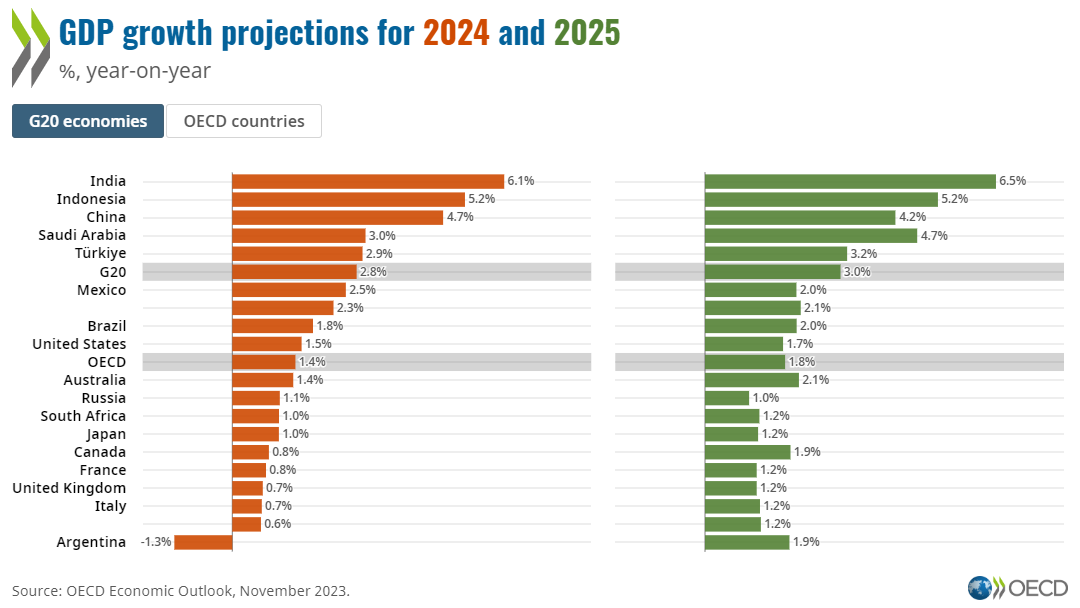

The organisation expects Australia's economy to swell just 1.4 per cent next year – down from 1.9 per cent this year – before recovering to 2.1 per cent in 2025.

READ MORE: At least one dead after US military aircraft crash

The global outlook

That 2024 figure is exactly the OECD average, as weak growth in the UK and the major European economies drags down the Asian powerhouses of India, Indonesia and China.

Globally, 2.7 per cent growth was predicted in 2024 from an expected 2.9 per cent pace this year. That would amount to the slowest calendar-year growth since the pandemic year of 2020.

Despite the gloomier outlook, the organisation was "projecting that recessions will be avoided almost everywhere", Cormann said.

However, he added, there are risks that inflation will stay persistently high and that the Israel-Hamas conflict and Russia's war in Ukraine could affect prices for commodities, such as oil or grain.

A key factor in the slowdown is that the OECD expects the world's two biggest economies, the United States and China, to decelerate next year. The US economy is forecast to expand just 1.5 per cent in 2024, from 2.4 per cent in 2023, as the Federal Reserve's interest rate increases – 11 of them since March 2022 – continue to restrain growth

For now, the American economy looks strong: The Commerce Department reported Wednesday that US economic growth came in at a brisk 5.2 per cent annual pace from July through September, helped by strong consumer spending and an uptick in private investment.

The Chinese economy, beset by a destructive real estate crisis, rising unemployment and slowing exports, is expected to expand 4.7 per cent in 2024, down from 5.2 per cent this year.

China's "consumption growth will likely remain subdued due to increased precautionary savings, gloomier prospects for employment creation and heightened uncertainty″, the OECD said.

The organisation noted the slowdown had so far had "limited impact" in Australia, led by commodity exports and the lifting of Beijing-imposed trade restrictions on thermal coal.

Also likely to contribute to a global slowdown are the 20 countries in the European Union that share the euro currency. They have been hurt by heightened interest rates and by the jump in energy prices that followed Russia's invasion of Ukraine.

The OECD expects the collective growth of the eurozone to amount to 0.9 per cent next year – weak but still an improvement over a predicted 0.6 per cent growth in 2023.

"A key takeaway today is the stronger outlook for the US, which we've revised up for 2024, but a weaker outlook for Europe, which we've revised down," OECD chief economist Clare Lombardelli told reporters.

- Reported with Associated Press

from 9News https://ift.tt/XWdRF2o

via IFTTT

Comments

Post a Comment