The clock is ticking for Aussies who left their tax return to the last minute, as the minutes while away to the October 31 deadline.

If you don't lodge today, you could be facing a hefty fine.

The deadline only applies if a person is required to submit a tax return and if they choose to lodge it themselves without using a registered tax agent.

READ MORE: Why are Australia's interest rates still rising?

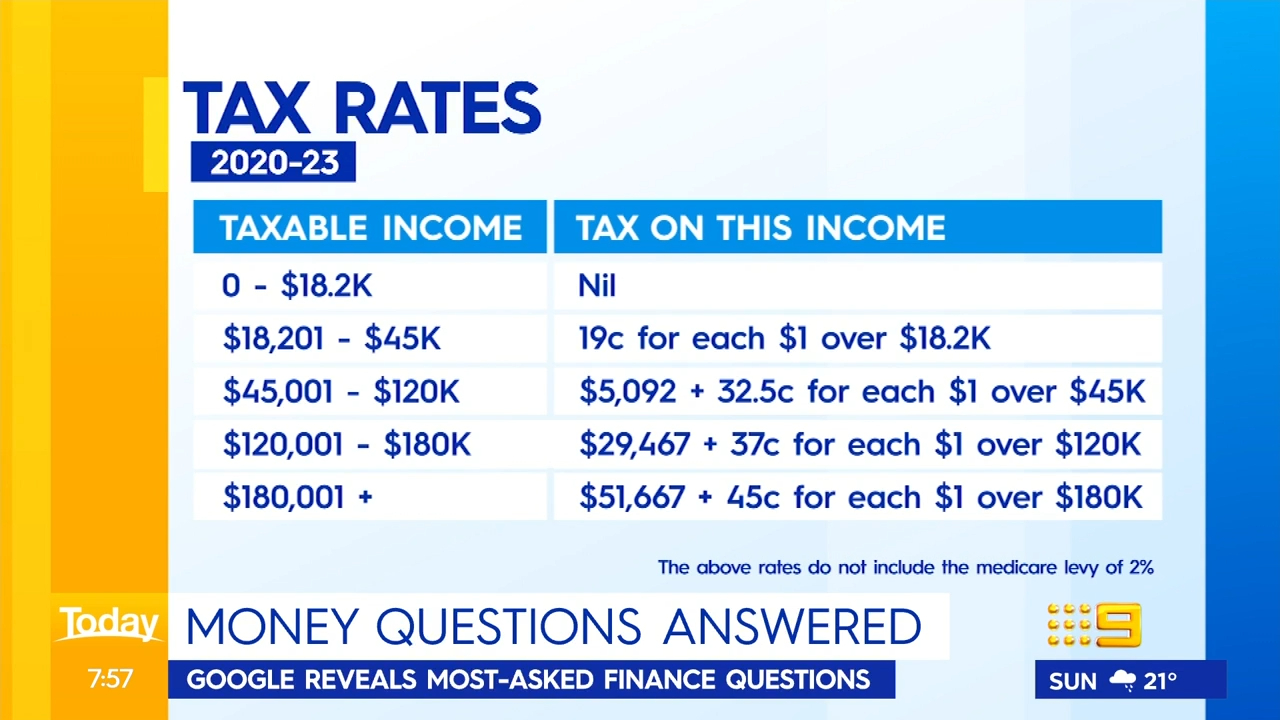

Most people who earn more than the tax-free threshold, currently at $18,200, are required to lodge a tax return.

Failure to submit a tax return results in a fine of one penalty unit (or $222) for every 28-day period that the tax return is overdue.

The Australian Taxation Office (ATO) says the maximum fine is five penalty units, or $1110.

As of the end of September, more than 8.8 million people had already lodged their tax returns, ATO figures show.

At the same time last year that figure stood at more than 8.4 million.

READ MORE: What you can and can't claim on your tax return

How do you lodge your tax return?

All you have to do is log on to the ATO website and most of the details including personal and income information should already be filled out for you.

Loh said you just need to check the information is correct, add any additional income, claim your eligible deductions and bam - you're done.

Don't forget that eligible deductions include working-from-home expenses which was brought in during the COVID-19 pandemic.

"You have a choice of three different methods for making your claim; the 80 cent per hour flat rate, the 52 cent per hour flat rate or the 'actual' method," Director of Tax Communications at H&R Block Mark Chaman said.

"Once your return is lodged, you can check its progress any time using the ATO app, or online using myTax," he said.

If you are having trouble lodging your return you can contact the ATO, especially for anyone currently impacted by major flooding plaguing NSW, Victoria and Queensland.

"If you're impacted, we understand that tax is not your number one priority right now. We can help you sort out your tax affairs once you've had time to deal with more immediate problems and recover," Loh said.

What if I've made a mistake?

No fear, not all hope is lost.

Loh said you can easily make an amendment if you need to simply by logging online again.

"You can do this online using myTax or by contacting your registered tax agent," he said.

"If you need to make an amendment, we strongly recommend waiting until your return has been processed and you have received your Notice of Assessment.

"This will help avoid processing delays."

READ MORE: Australia Post announces its domestic delivery deadlines for Christmas

But wait, there's a sweetener if you do it

There is also an incentive this year to lodge it, other than the big fine, you could get $1500 back in your pocket.

"If your income is less than $126,000, you'll get at least some or all of the offset. For those who earn less than $37,000, the offset is $675," Chaman said.

"For those who earn less than $37,000, the offset is $675. If you earn between $37,000 and $48,000, the offset will increase up to a maximum of $1,500.

"Those with annual incomes of between $48,000 and $90,000 will receive the full $1,500 offset.

"However, those who earn more than $90,000 will see the offset gradually fade out. If you earn more than $126,000 a year, you won't get any offset on your tax payable for the year."

EXPLAINED: NSW to phase out more single-use plastics on November 1

from 9News https://ift.tt/YqrJRXE

via IFTTT

Comments

Post a Comment