Australian property values have suffered their biggest monthly drop in almost 40 years as the market's downturn accelerates.

CoreLogic's national Home Value Index recorded a fourth straight month of decline in August, with the retreat in prices accelerating and covering more of Australia.

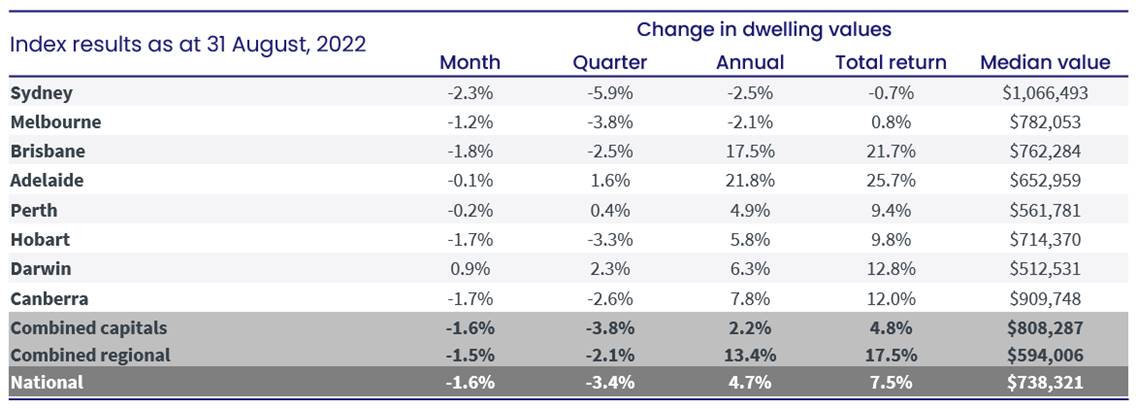

The drop in August was 1.6 per cent, the biggest month-on-month decline since 1983.

READ MORE: Dawson police say 'still work ahead' as bail bid expected

Every capital city apart from Darwin is now in a housing downturn, and regional Australia isn't too dissimilar, with only South Australia recording an increase in regional housing values for the month.

Sydney continued to the lead the downswing, with values falling -2.3 per cent in August.

But Brisbane also saw an accelerated decline, with values falling -1.8 per cent.

CoreLogic's research director, Tim Lawless, said Brisbane's shift into decline had been acute after almost two years of sustained growth due to record high internal migration and relative affordability.

READ MORE: Global weather agency predicts rare 'triple-dip' La Nina

"It was only two months ago that the Brisbane housing market peaked after recording a 42.7 per cent boom in values," Lawless said.

"Over the past two months, the market has reversed sharply with values down -1.8 per cent in August after a -0.8 per cent drop in July."

In regional areas, the fall was almost as extreme, with a 1.5 per cent drop in August.

That follows a sharper upswing though, with regional prices surging more than 40 per cent from March 2020 to January 2022, compared to 25.5 per cent for the capital cities.

READ MORE: Taiwan forces fire at drones flying over island near China

"The largest falls in regional home values are emanating from the commutable lifestyle hubs where housing values had surged prior to the recent rate hikes," Lawless said.

"Over the past three months, values are down eight per cent across the Richmond-Tweed, -4.8 per cent across the Southern Highlands-Shoalhaven market and -4.5 per cent across Queensland's Sunshine Coast."

Only seven areas recorded a rise in housing values in August, including the northern suburbs of Adelaide (0.9 per cent), Perth's North East and Mandurah (0.6 per cent/ 0.5 per cent respectively) and the Coffs Harbour-Grafton region (0.6 per cent).

Despite the recent weakness, housing values across most regions remain well above pre-COVID levels.

Home values in all capital cities and rest-of-state regions, besides Melbourne, remain 15 per cent more above the levels recorded in March 2020, implying most home owners have a significant equity buffer before their home is likely to be worth less than what they paid.

"A 15 per cent peak to trough decline would roughly take CoreLogic's combined capitals index back to March 2021 levels," Lawless said.

"Additionally, many home owners would have had at least a 10 per cent deposit and paid down a portion of their principal, the risk of widespread negative equity remains low."

Lawless expected the downturn will continue to play out through the remainder of the year, and possibly into 2023.

"It's hard to see housing prices stabilising until interest rates find a ceiling and consumer sentiment starts to improve," he said.

from 9News https://ift.tt/nGPrWgz

via IFTTT

Comments

Post a Comment